16 pair trading project with EA CommunityPower

hi everyone

i am made this for hobby

lets go....

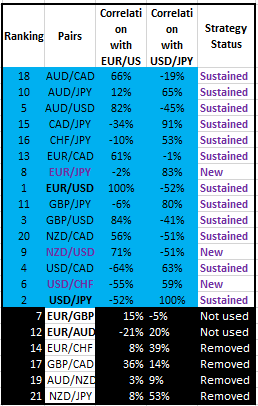

pair is

1.AUDCAD

2.AUDJPY

3.AUDNZD

4.AUDUSD

5.CADJPY

6.CHFJPY

7.EURCAD

8.EURCHF

9.EURUSD

10.GBPCAD

11.GBPJPY

12.GBPUSD

13.NZDCAD

14.NZDJPY

15.USDCAD

16.USDJPY

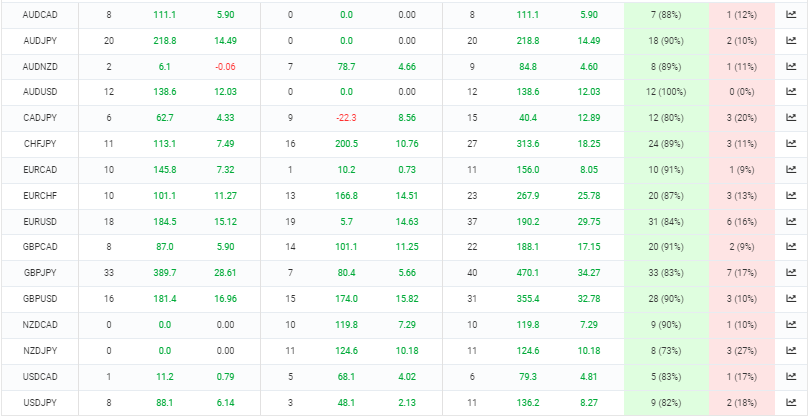

see the what the pass...

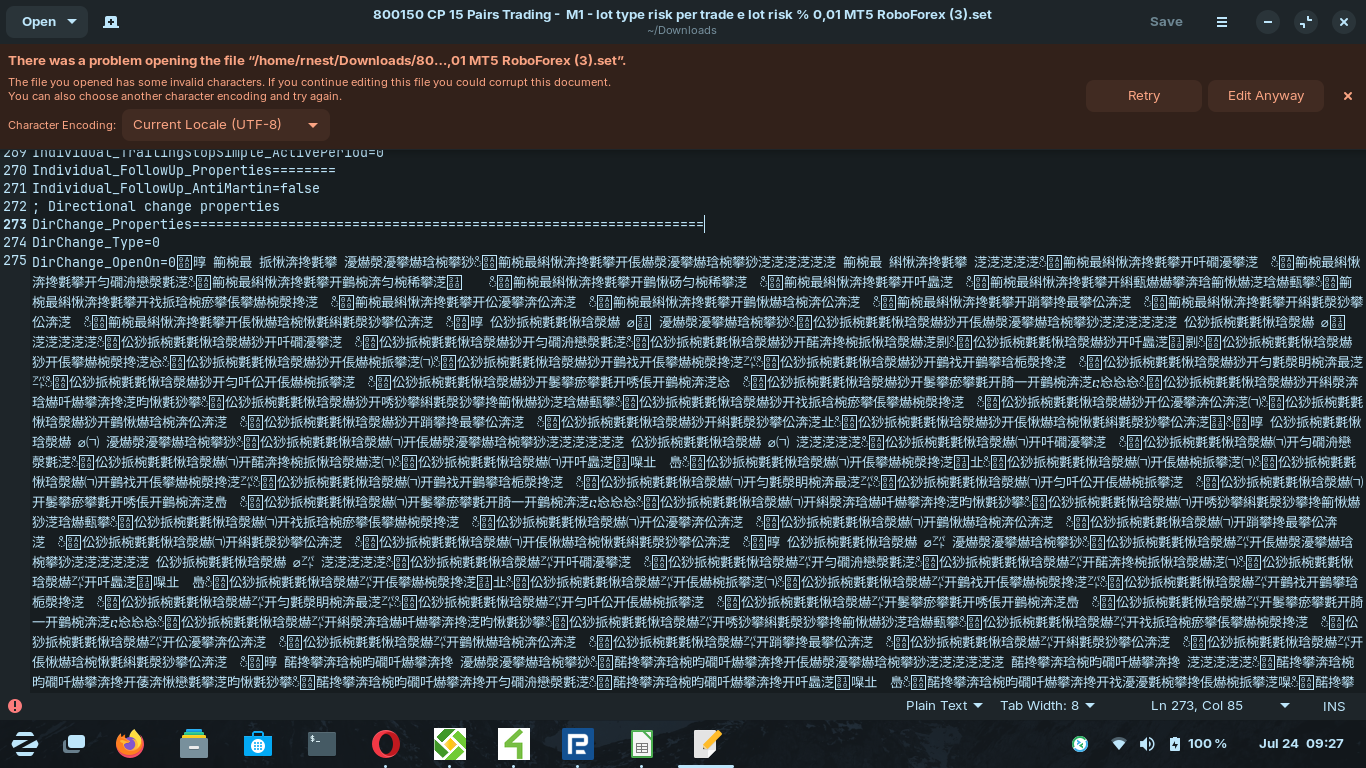

file set

live signal =https://www.myfxbook.com/members/VicJay/robo16pairs/10699831

How would you rate the customer service you received?

Satisfaction mark by ferdinand tampubolon 2 years ago

Add a comment about quality of support you received (optional):

Thank you - Orders are now placed, even though ICM charges commission per lot, it opened trades without me filling the commission column. So far, it appears to open one trde per pair per day at 20:00 (ICM Server time), will observe for a while (a month or two) and revert.

I am very glad to hear it.

Do you have a myfxbook account?

very good for comparison between roboforex and icmarket.

where later the version will be updated for improvements