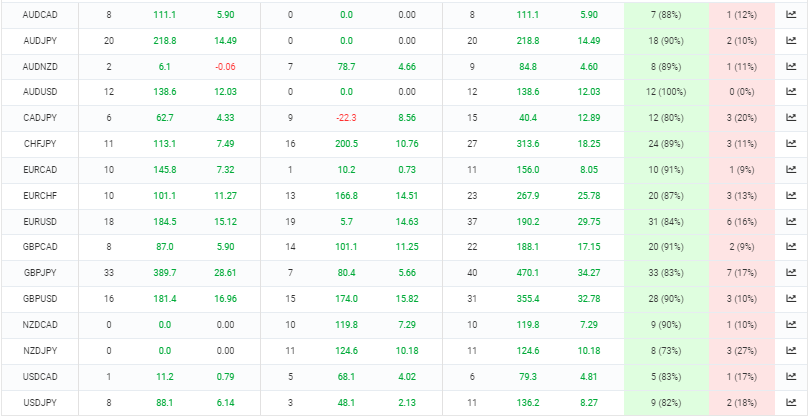

16 pair trading project with EA CommunityPower

hi everyone

i am made this for hobby

lets go....

pair is

1.AUDCAD

2.AUDJPY

3.AUDNZD

4.AUDUSD

5.CADJPY

6.CHFJPY

7.EURCAD

8.EURCHF

9.EURUSD

10.GBPCAD

11.GBPJPY

12.GBPUSD

13.NZDCAD

14.NZDJPY

15.USDCAD

16.USDJPY

see the what the pass...

file set

live signal =https://www.myfxbook.com/members/VicJay/robo16pairs/10699831

How would you rate the customer service you received?

Satisfaction mark by ferdinand tampubolon 2 years ago

Add a comment about quality of support you received (optional):

I understood

btw it is work on experimental audusd pair

PHOTO

audusd_sp500.set