MT5 - BTCUSD Optimisation - Any ideas where to start with the settings?

Hello,

Just wondering if anyone has any ideas where to start with settings for crypto?

Hello,

Just wondering if anyone has any ideas where to start with settings for crypto?

Thanks for sharing!

Please, attach set-files as well, I'll check them as soon as I have some time.

Hi All,

From playing around the last few days, I have found the following methodology helpful. I would just keep everything at default

1. Optimise the oscillator signal for oscillator 1

I first start off with the standard setup of BTCUSD on M5 for the current year to date with backtesting in mind. I have just stuck with complete optimisation as I sometimes get strange results with the fast one on a deposit of 1000. I will firstly optimise the type, indicator and time frame. I will produce the optimisation table and select the one with the best outcomes in terms of drawdown, profit, number of trades etc. I will run single tests on different options to look at their individual characteristics like % trades won and time in that position.

To further improve on this, I will then also level up and level dn and run an optimisation on them also.

2. I will then repeat this for the 2nd oscillator/indicator and volatility indicator.

3. Basic Risk Management settings.

After I had selected the best settings for the above 3 indicators, I would then run optimisations on the stoploss pts, global stoploss

4. Profit settings - run complete optimisations on the take profit settings on points.

Going for a brute force approach here as you can see. Thing is, using a laptop on overnight or other computer when you wake up the results are there in the morning.

One word of warning - I have tested these under idealised conditions with backtesting only. I have not risked any of my own money. But will do eventually once I tune it to a reasonable standard. Unfortunately, one feature of these is that they do hold their positions for a long time! so you will get hit with broker fees as a result.

ETHUSD, M5, 01012020-11082020 Backtest Report.html

Hi,

So here is an one setting for ETHUSD. But one major drawback is that it holds a position for a long time! I will try an locate the old optimisation reports and their files.

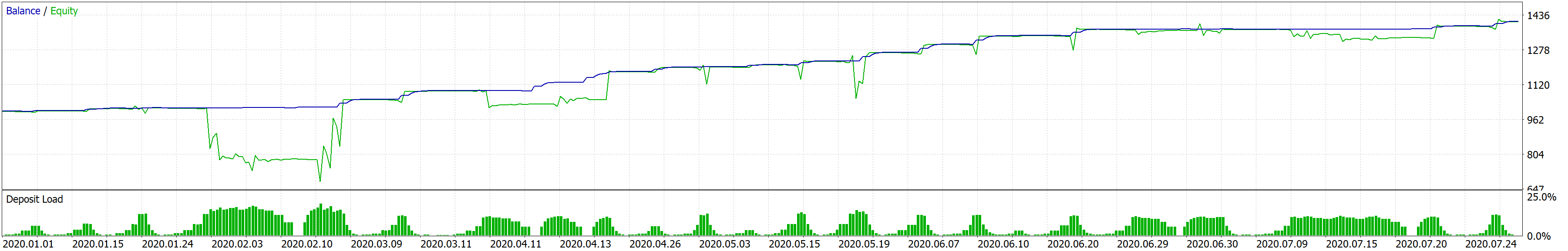

BTCUSD, M5, 01012020-11082020 Backtest Report.html

Hi,

So far I have come up with this for BTCUSD. A modest profit and balance gained in a turbulent year. But the resistance to drawdown at least made it a bit more resilient. I will so some more testing for a better set up using the new volatility filters.

Voi-la! ;)

Great! Please, share your results.

BTW, you can find previous optimization results on the Overview tab, just start to type Expert name in the search window.

After selection, just Start the optimization, it will be finished immediately and you'll see the results.

I did find them, but they are labelled with stuff that doesn't state the parameters optimised for! So I end up looking for ages. I will just have to save them one at a time.

Great! Please, share your results.

BTW, you can find previous optimization results on the Overview tab, just start to type Expert name in the search window.

After selection, just Start the optimization, it will be finished immediately and you'll see the results.

Hi,

I will publish them. Problem is, I don't know where I put them! I will run them again and publish the results for outside scrutiny and assessment. So far I would firstly optimise for signal on the 1st oscillator, then the profit limits and finally the stop losses.

I think by publishing all, people can see which scenario suits them in terms of profit, drawdown etc.

Great! Please, share your results.

BTW, you can find previous optimization results on the Overview tab, just start to type Expert name in the search window.

After selection, just Start the optimization, it will be finished immediately and you'll see the results.

You can leave last 1-2 months for forward test. So, optimize on 01.06.2019-01.06.2020 and then check the best sets on 01.06.2020-now